SUMMARY:

- Budget Reconciliation allows Senators to pass measures with 51 votes rather than 60

- Provisions in the AHCA may be deemed extraneous under Senate Byrd Rule

- ACA Reporting Requirement cannot be eliminated through reconciliation

- The Recent CBO report spells difficulty for the Repeal effort moving forward

Recent headlines have been littered with phrases such as: “Budget Reconciliation”, “Byrd Rule”, “CBO Reports”, and “Filibuster” etc etc. What does it all mean? How does it tie together and most importantly how does this affect those working in the insurance industry?

Budget Reconciliation???

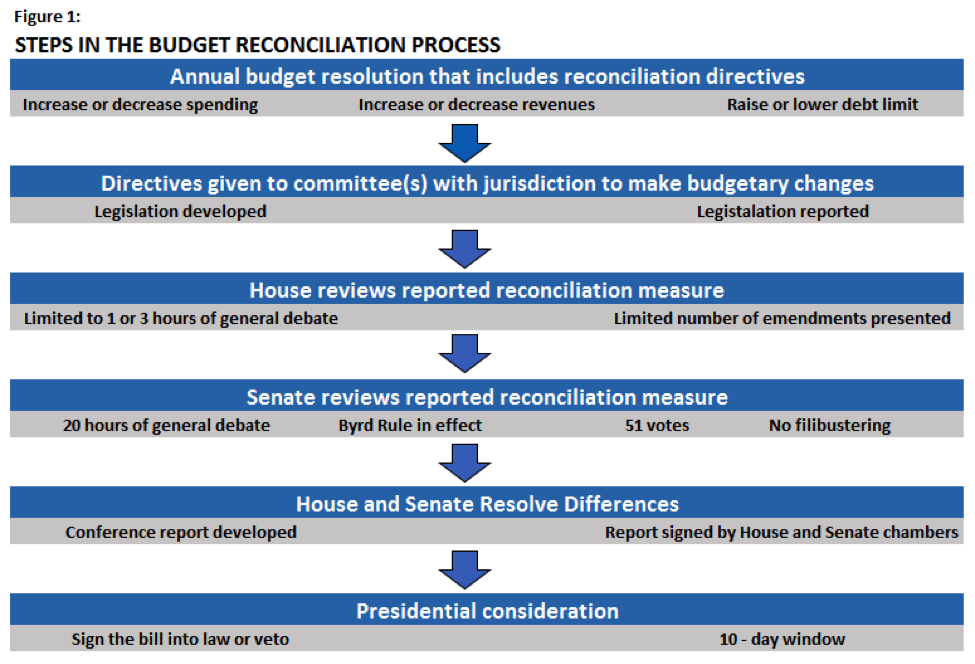

To start, let’s take a look at what budget reconciliation is. Simply put, Budget Reconciliation is a process that allows Congress to make changes more quickly than under regular rules (See Figure 1). Every year Congress is required to adopt an annual budget resolution. This serves as Congress’s statement on items such as: revenue, debt limits, and expenditures. Congress uses this to set federal spending goals for the next five years. When additional legislation that affects spending is needed beyond that which is normal, Congress can use the process known as Budget Reconciliation. Why are we talking about this? This is what Republicans in Congress are currently using in an attempt to pass new healthcare legislation in the Senate. Republican lawmakers are hoping that this can accelerate the process and lower the number of needed votes in order to pass the new law.

Why are Republicans using this to Pass Healthcare Reform???

Under normal Senate rules, there is no defined amount of time for debate on each bill. 60 Senate votes are required to end debate and move into an up or down vote on legislation. This means that any single Senator can speak on and on forever on a bill thus thwarting its ability to move forward into law. This is known as a filibuster.

Here’s the key to Budget Reconciliation. The Budget Act limits the Senate debate time on reconciliation measures to 20 hours. After 20 hours, the debate ends. This means that under budget reconciliation a total of only 51 votes are needed in order to pass measures as opposed to the standard 60 that would be needed to overcome a filibuster. If you’ve been paying attention you will know that Republicans in Congress do not currently hold 60 seats, so this is their best option for passing healthcare reform. Under Reconciliation, Republicans can pass legislation without the help of any Democrats. In addition to these limits the Senate also operates under rules that govern the subject matter of reconciliation. These limits are outlined in the Byrd Rule.

The Byrd Rule???

The Byrd Rule serves to set limits on the subject matter that can be considered under any reconciliation matter. A provision is considered extraneous if:

- It does not produce a change in expenditures or revenues.

- The net effect of the provisions reported by the committee fails to achieve the reconciliation instructions.

- It is outside the instructed committee’s jurisdiction.

- It produces changes in expenditures or revenues that are only incidental to the non-budgetary components of the provision.

- It increases or decreases net expenditures or revenues during a fiscal year that is not covered by the reconciliation instructions.

- It recommends changes to Social Security.

The Byrd Rule in the Media

The Byrd rule is being talked about so much in the media because some opponents of the AHCA claim that one of the key provisions of the AHCA should be considered “Extraneous” under the Byrd Rule and therefore cannot be contained in a Budget Reconciliation bill. This provision is the 30% penalty imposed on those individuals who do not maintain continuous coverage throughout the year.

Under the AHCA bill, insurance companies in certain states can charge a member 30% more for their premiums if coverage is not maintained in the previous year. Since this extra money would go to insurance companies rather than the federal government (as it does under the ACA’s individual mandate) the provision may be considered out of conformity with Senate regulations. Without the 30% provision, the AHCA falls apart as insurance risk pools become unbalanced and people wait to buy insurance until they are very sick.

Reconciliation Limits on Repealing Reporting Requirements

Additionally, a little known fact is that even though the proposed healthcare bill reduces the Individual and Employer penalties to $0, it cannot remove the requirement to report qualified offers of coverage. What this means is that budget reconciliation cannot be used to change the current reporting requirements under the ACA. Additionally, marketplace premium tax subsidies are proposed to stay in place until the year 2020 at which time they are to be replaced by less generous tax credits. Reporting will still be needed in order to track who is eligible for a subsidy and then eventually who is eligible for a tax credit. We first uncovered these details in a recent blog: House Passes AHCA Bill – What This Means for Employer Compliance.

The Congressional Budget Office and the AHCA

On May 25th, the CBO released its report on the amended AHCA bill that passed in the House. The report found that 23 million Americans could lose their health insurance by the year 2026. Before the Senate could even take a look at the bill, the CBO was required to report on it. Since there were actually budgetary savings implemented by the bill it is now free to move to the Senate, but from there it will not be an easy road.

Final Thoughts

The road ahead for healthcare repeal is a bumpy one at best. Congressional Republicans are faced with the daunting challenge of living up to their campaign promises of “Repealing and Replacing” the ACA while at the same time trying to preserve coverage rates and lower premiums. This is a challenge that may prove “undoable” and in the end lawmakers may have to compromise.