Complete Your Reporting Experience With Our Top Rated Add-on Services.

Selecting an Add-on is a perfect complement to our reporting packages, these services add value, convenience and protection.

PRINT & MAIL SERVICE

1095 Forms Mailed Direct to Your Employees

Per IRS regulations, organizations are required to furnish a copy of the Form 1095-C to employees.

- $2.75 per form

- Fast Turnaround

- Ship To Employer Option

IRS AUDIT & INQUIRY ASSISTANCE

Gain An Advocate When Dealing With IRS

Secures a representative from our team as your assigned advocate in working with you to develop IRS response strategies.

- $100 – $300 (for most businesses)

- IRS Penalty Letter Evaluation

- Only available when an ACA reporting package is purchased, not sold separately

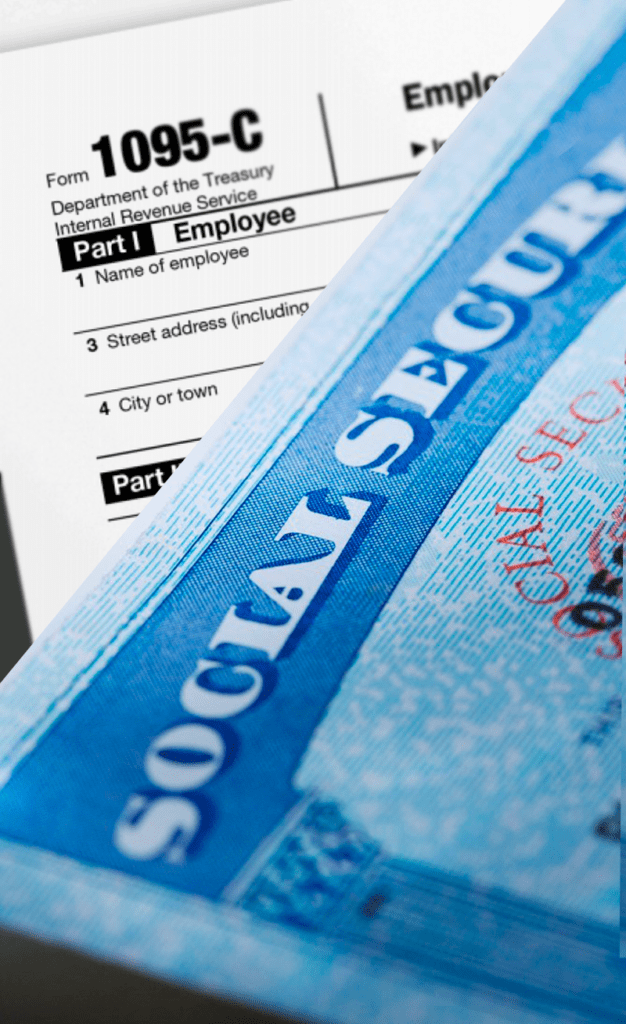

Taxpayer Id Number (TIN) Reconciliation

When the IRS highlights a mismatch in employee data.

Assistance with IRS Code Failure to File Correct Information Returns that imposes a penalty per return for an infraction related to information returns filed with a missing/incorrect TIN.

- $150 Admin Fee + $1.00 per correction

- Consulting & Compliance Protocol

- Form Collection & Refiling with IRS

Stand-Alone Employer Services

Our E-File Only and ACA VHT services are not connected to a reporting package but offer direct assistance from our ACA team.

E-FILE ONLY SERVICE

1094/1095 Data E-Filed To The IRS

Our team uses approved data for electronic transmittal via the Affordable Care Act Information Returns (AIR) online system.

- $350 admin fee then $1.00 per form

- Secure Data Transfer

ACA VARIABLE HOUR TRACKING SERVICE

IRS Compliant Employee Tracking for the ACA.

Access to an account manager and customized software for tracking employees hours. System notifications to help know when an offer of coverage should be made.

- Minimal Data Requirements

- No Set-up Fees

- Starting at $250/month